Description

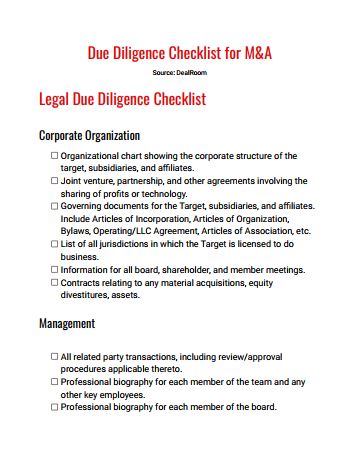

What investment structures are available?

- Representative office or Branch

- Direct Investment

What employment issues should an investor be aware of ?

- Definite with the maximum duration of 36 months

- Indefinite

What are the foreign exchange issues?

- Fairly straightforward

- Must open a capital account at one bank

- Permitted forex transactions

How are disputes resolved?

- Investment Law

What is the tax regime in Vietnam?

- Corporate Income Tax (CIT)

- Withholding tax or Foreign contractors tax (FCT)

- VAT

- Export – Import Duties

- Personal Income Tax (PIT)

What are the financing issues?

- Mortgages

- Documentation

- Consents and approvals

- Allow sufficient time to set up business in Vietnam

Reviews

There are no reviews yet.